Whether it’s a beach condo or a waterfront home, your short-term rental feels like your own home and certainly deserves as much love and care. That’s why when property damages happen, it can be quite disappointing.

As vacation rental managers in St. Pete Beach and Tampa Bay, Florida, we’ve identified that guest damage is a typical concern among our real estate owners in this region.

However, there’s often much confusion surrounding the best practices for damage protection and the process of filing a damage claim on OTA platforms. In this blog, we’ll bring you a guide to damage claims, including the steps to file a damage claim on Airbnb and Vrbo, and real market insights based on the data of a real property management company similar to us.

We intend to show that damage claims are not as significant of an issue as most hosts assume.

Let’s start from the beginning…

What are damage claims after all?

When guests book your beach rental, they must follow the specific rules and guidelines that ensure the proper care for the property.

If you discover that they didn’t and, as a result, caused property damage, you can file a damage claim. With large OTAs like Airbnb and Vrbo, this is a process that happens online through a resolution center.

At Resort Rentals, we run our own platform to accept bookings and we rely on a dedicated team to evaluate and manage damage claims. Our policy is slightly different: we guarantee that any damages caused by guests will be paid by the guest; otherwise, we’ll cover the costs, with the exception of normal wear and tear. More on that later.

Disclaimer: not all guests have ill intentions. Some will inform hosts immediately after accidentally damaging something and even offer to cover the repair or replacement costs. Still, some guests might try to hide the incident or, if they agree to cover the costs, they often offer a lower amount than what the host might expect.

That’s why you need moderators and a system in place that allows you to withhold a security deposit if needed.

Guest damages are not as common as many hosts think, but they do happen. Therefore, being prepared and understanding the process behind filing damage claims is useful in the short-term rental industry. Pictured: Lands End in Treasure Island.

Industry stats and insights on damage claims

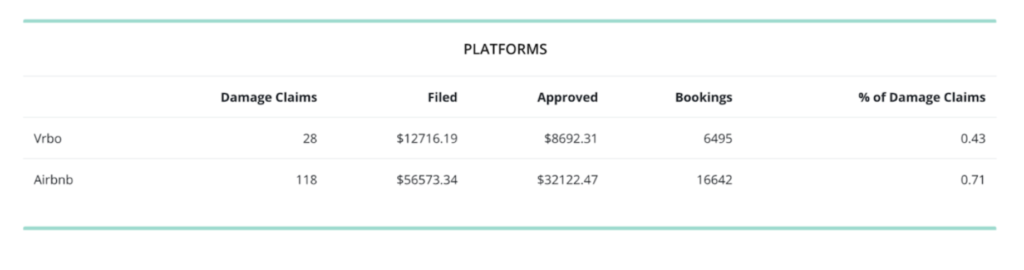

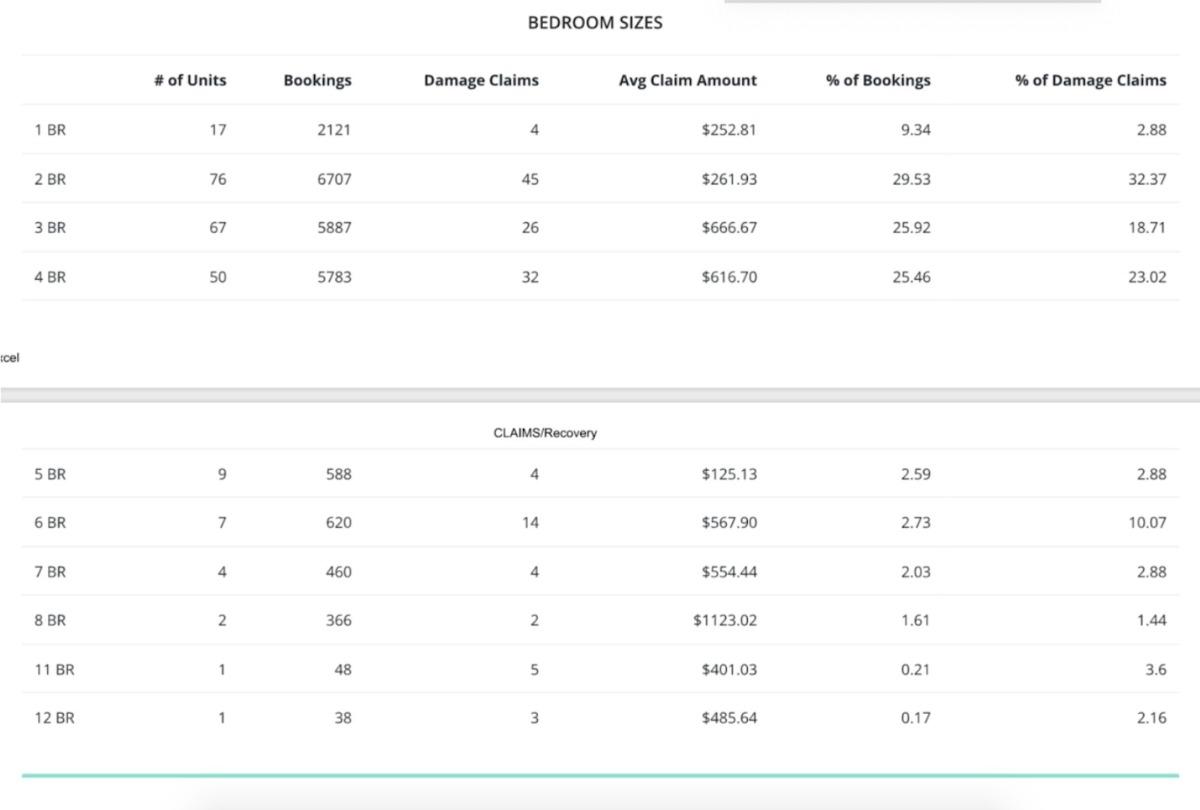

We’ve acquired very interesting data from a property management company of a similar scale operating in a different market that can really shed light on damage claims.

The statistics and graphs below cover about 20,000 bookings. Let’s delve into some key conclusions.

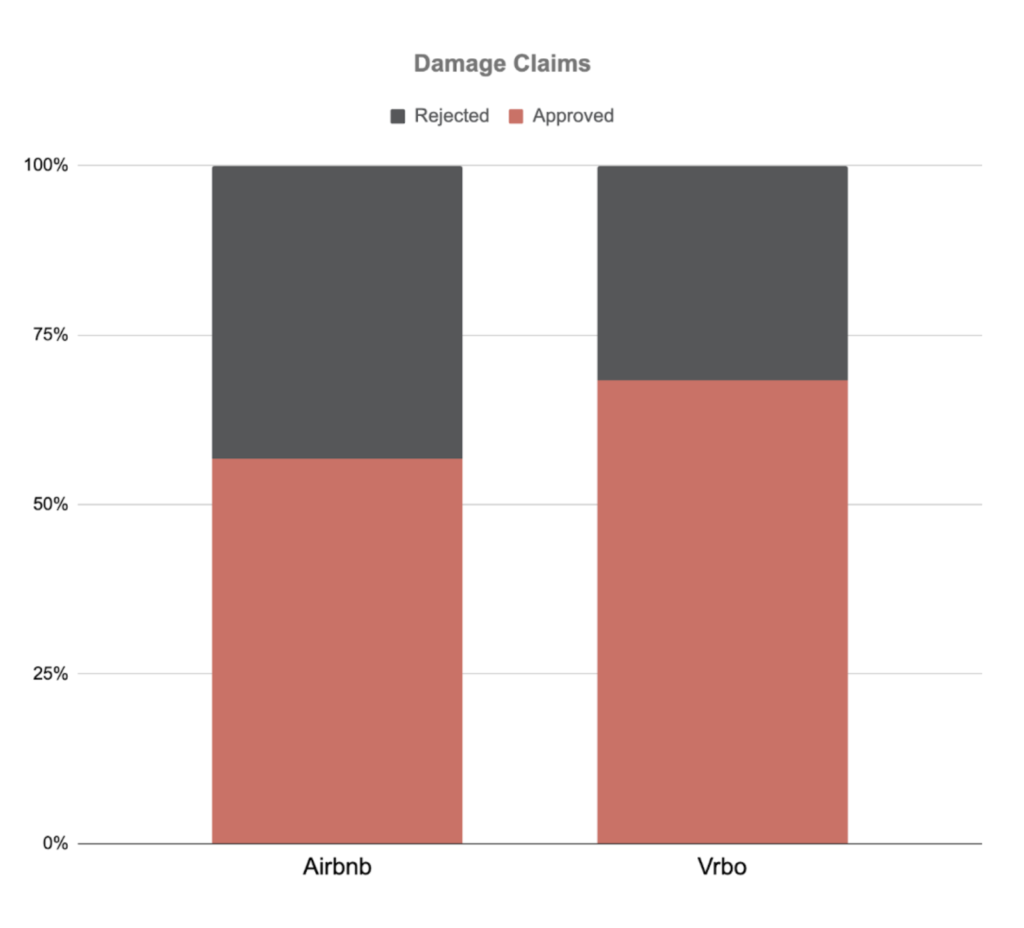

Damage claims per platform

The chart above shows that our partner gets approval for roughly 60% to 70% of the damage claims they file — more specifically, 68.29% on Vrbo and 56.75% on Airbnb. It’s interesting to note this significant difference between these two major platforms. Vrbo shows more approvals, 11.54% more than Airbnb.

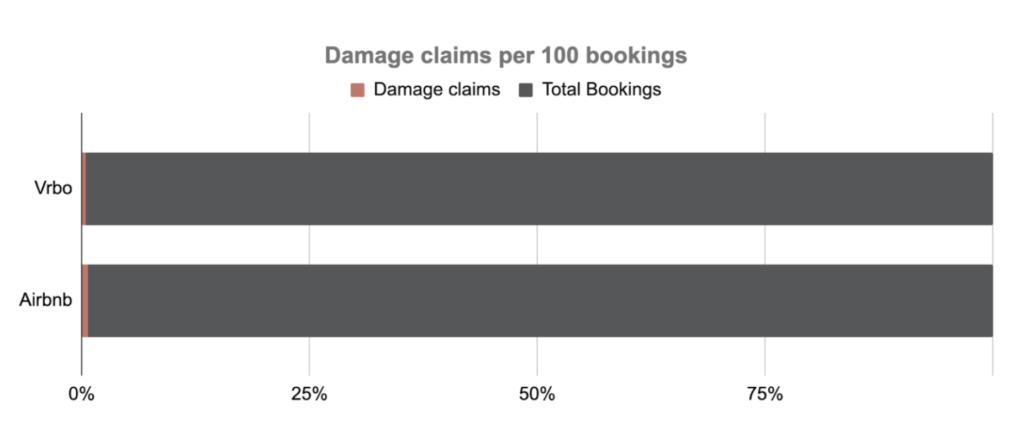

As we said before, property damage is not as much of a problem as hosts usually think. In the chart above, the indicator of damage claims is so small that it almost goes unnoticed. Our partner’s experience shows they occur in only 0.43% of all bookings on Vrbo and 0.71% on Airbnb.

Let’s consider Airbnb. With 100 bookings in a year, this translates to less than one claim per year. Not that big of a deal, is it? Still, damage claims do happen, so understanding how to manage them is important, nevertheless.

Raw data

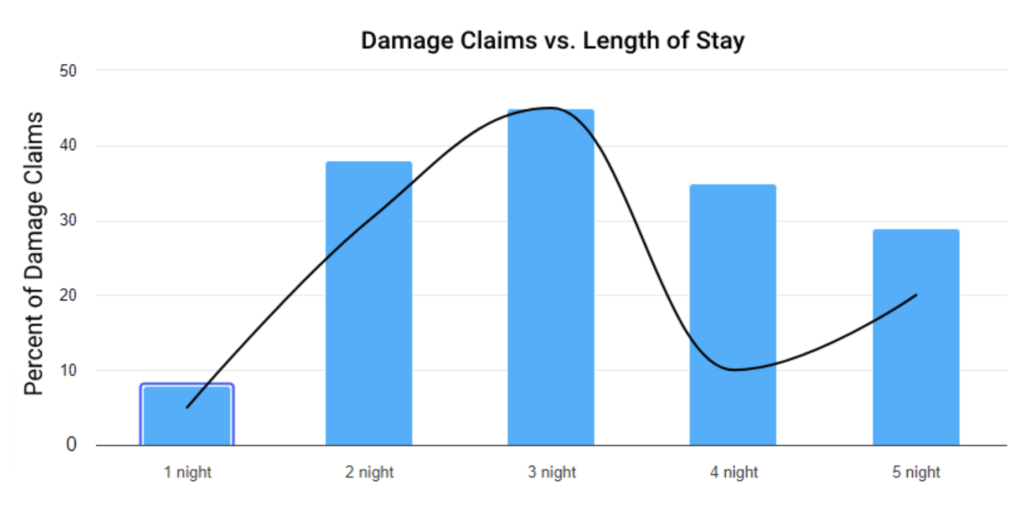

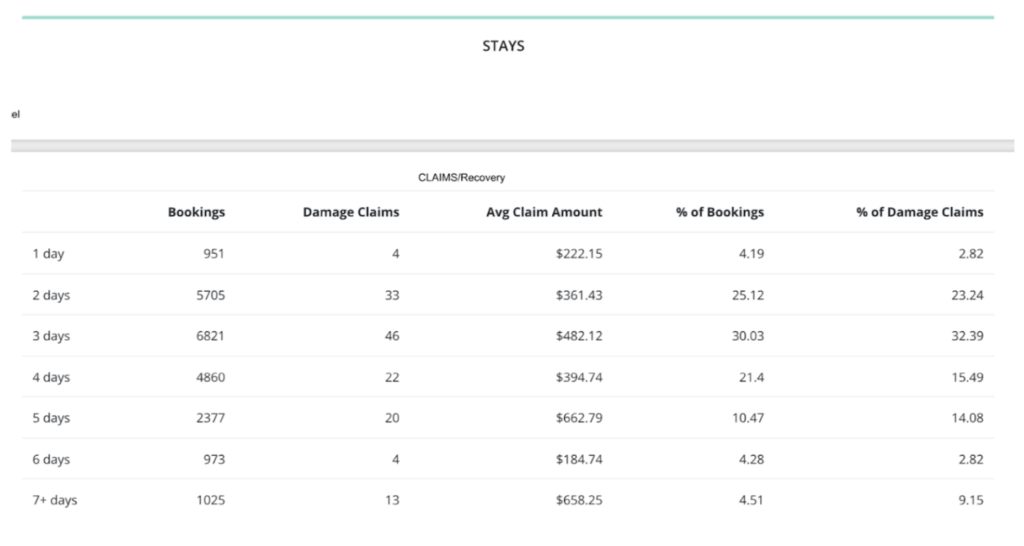

Damage claims vs. length of stay

Considering our partner’s average booking duration is three nights, it makes sense that the number of damage claims sees a spike right there on the chart.

But a careful look at this chart also reveals that shorter stays, typically of one or two nights, tend to result in as many or even a higher number of damage claims compared to longer stays of seven nights or more.

In theory, being longer, the latter would offer more opportunities to break something. No wonder why most vacation rental owners in the Tampa/St. Pete Beach region frown upon short stays.

Raw data

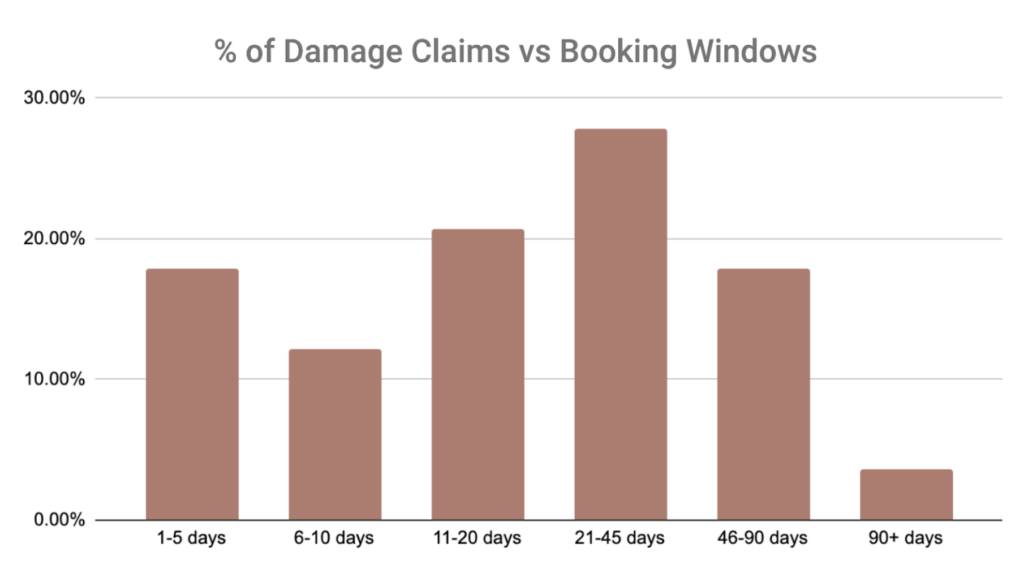

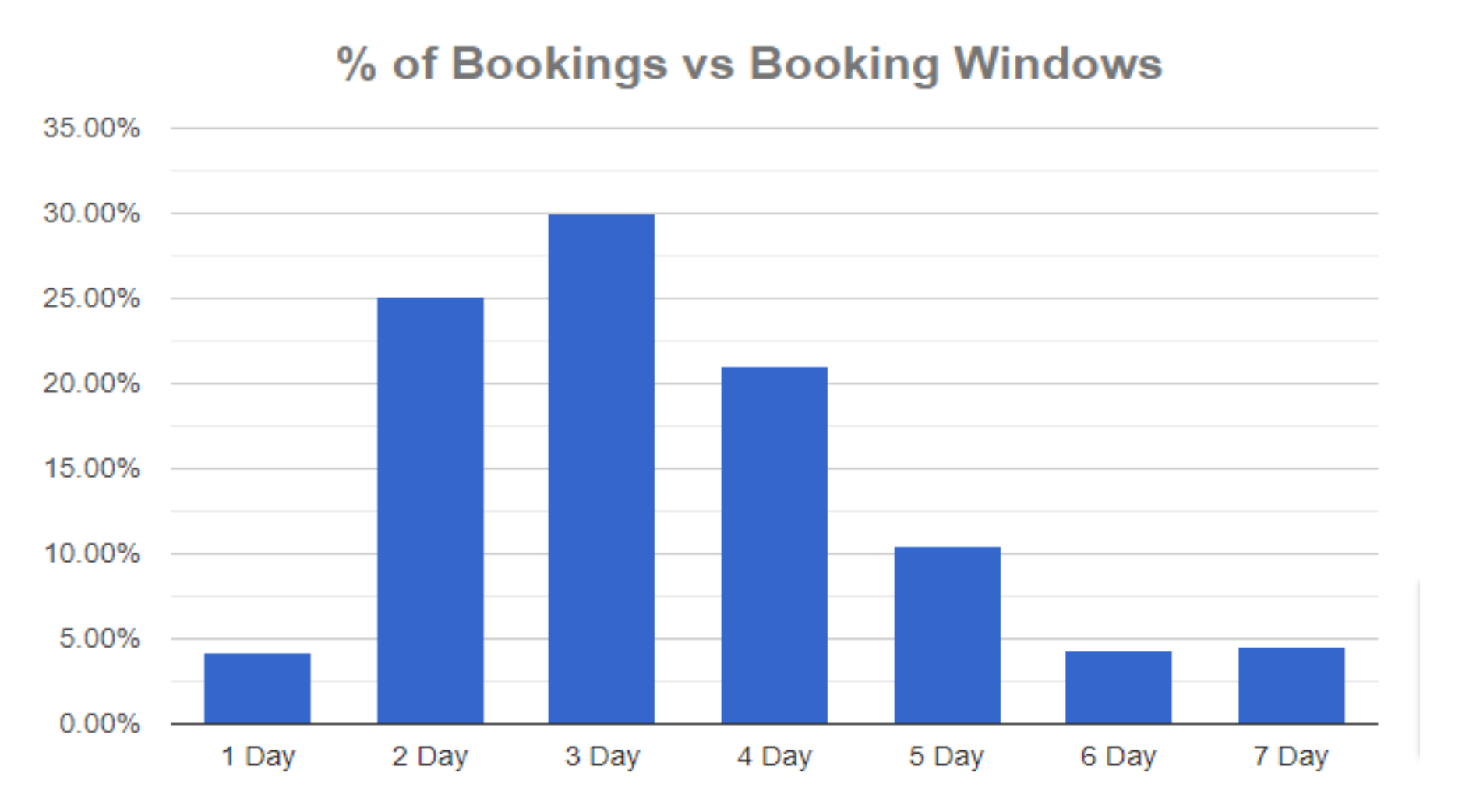

Damage claims vs. booking windows

With the charts above, we can see that bookings made far in advance, 90+ days ahead, for instance, tend to result in fewer damage claims. Surprisingly, though, last-minute bookings with just a 10-day window don’t seem to cause many problems either. We can only conclude that whether guests book well ahead or at the last minute, it doesn’t really affect hosts, at least when it comes to the issue of damage claims.

Raw data

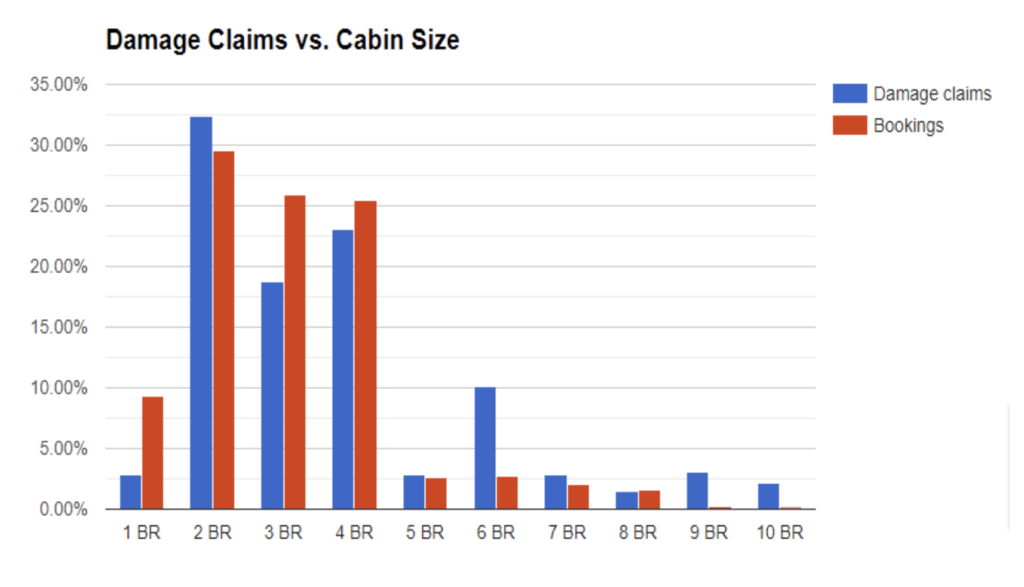

Damage claims vs. rental size

Another puzzling one is property size. There’s no direct link between the number of damage claims and rental property size. However, from this chart, it seems that as rental properties become bigger, the value of the claims tends to rise. This data lacks granularity, though, so it’s hard to draw any definitive conclusions.

Damage claim rates may also fluctuate considerably depending on the season, location, and the type of guests your property attracts.

Raw data

Step-by-step guide on how to file damage claims

The process of filing a damage claim is pretty straightforward and automated. However, there are some specific details on each platform that are best to pay attention to.

Let’s delve into the two big ones.

Steps to file a damage claim on Airbnb

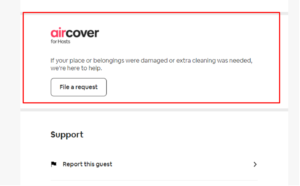

- Step 1. With Airbnb, you can start a damage claim through the Resolution Center, AirCover, and through the guest’s message thread.

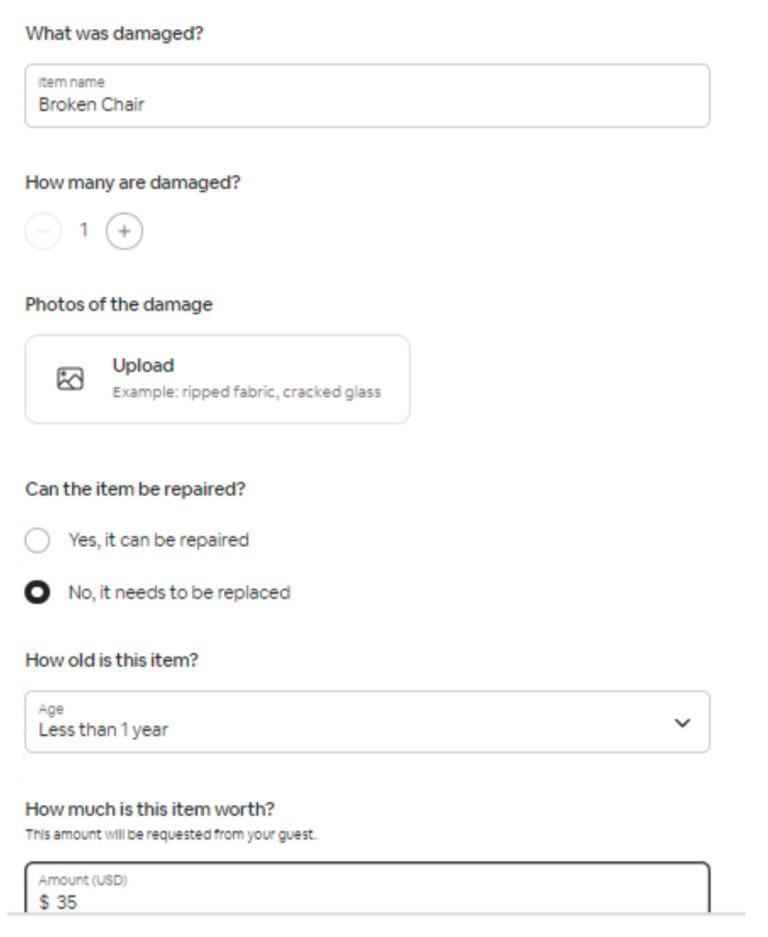

- Step 2. The second step is to fill in the details of what was damaged and, if possible, upload a picture as proof.

Pro tip: when the platform asks how old the item is, choosing ‘less than a year’ and pointing out that it cannot be repaired will increase your chances of receiving the full amount you’re charging the guest for.

Once this information is filled out, it will be sent to the guest. Guests have 24 hours to either accept or decline the claim.

If this 24-hour period expires or if they decline it, you can click on ‘Ask Airbnb for Help’ to request Airbnb to review the claim.

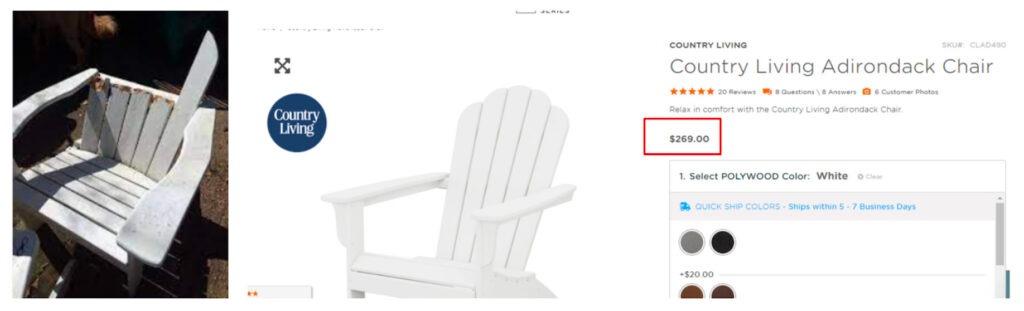

Always provide as many details as possible, such as photos showing the damage and receipts if you’ve already purchased a replacement, or even screenshots of the replacement item showing its cost if you haven’t acquired it yet.

Here’s an example:

Photos of broken item and replacement item

Good to know: having both a “before” and “after” photo of the damaged item is ideal evidence, and if these images are dated, it’s even better.

Important to know: there’s a 14-day window for filing damage claims after the guest has checked out. If 14 days have passed, the platform will reject your claim.

Steps to file a damage claim on Vrbo

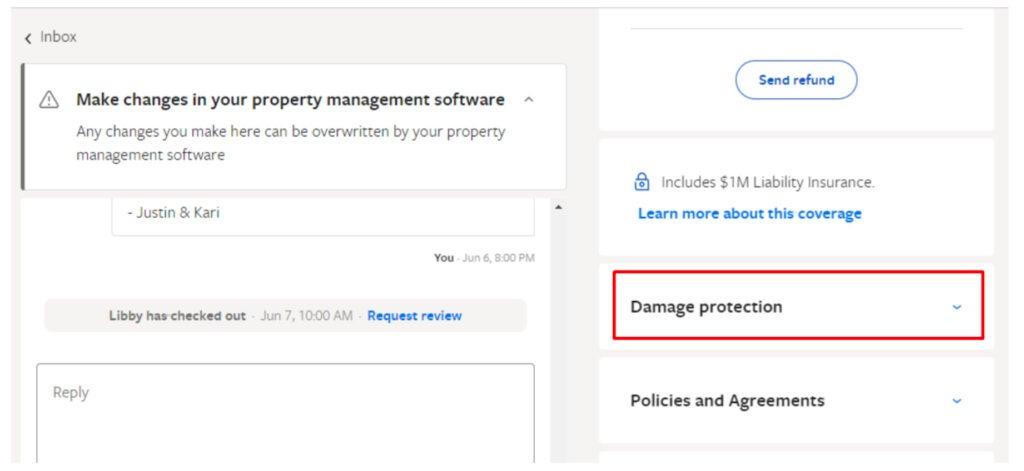

- Step 1. To get started with your damage claim on Vrbo, find “Damage Protection” in the sidebar of the message thread.

- Step 2. Select ‘Report Damage’ and specify the amount you intend to charge the guest. Just as with Airbnb, uploading complete documentation to the platform is important to support your claim. If a guest disputes or refutes what you are claiming, the platform will ask for proof and documentation to verify the charge.

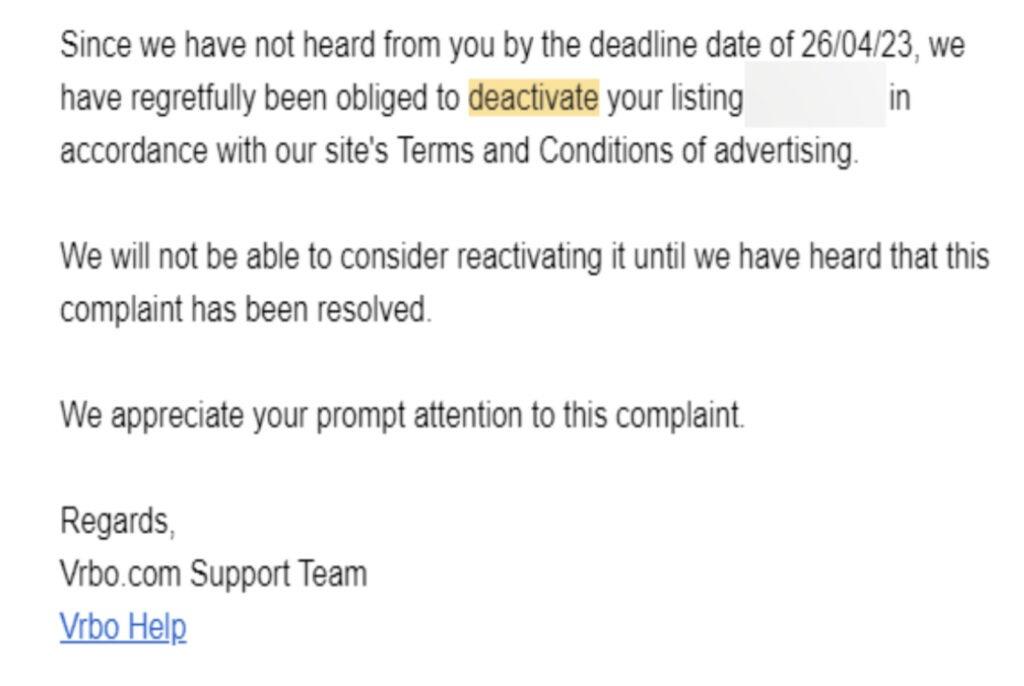

Heads up: it’s critical to keep in mind that if you cannot provide evidence of the damage within the established deadline, Vrbo may deactivate your listing.

With Vrbo, you have a 30-day window after the guest’s departure to submit damage claims. After this period has passed, you won’t be able to file a claim.

Good to know: if you’re using a Property Management System (PMS) connected to Vrbo, you can charge the credit card linked with the booking. But if you’re using Vrbo without a PMS, your only option is to make a claim against the damage deposit you’ve set up.

Distinguishing minor from major issues

Most of the time, guest damages are minor issues that can be fixed before the next guest checks in. Here are some of the common cases:

- Broken dishes and glassware

- Stained sheets and towels

- A kitchen in need of some extra cleaning

- Spills, like wine on the carpet

These are smaller issues that don’t cause many headaches except for additional cleaning or replacement expenses, and you shouldn’t spend too much energy worrying about them.

Instead, save your energy for bigger damages, which can happen from time to time.

For instance:

- Broken furniture

- Malfunctioning appliances

- Structural damage

- Valuable items that have been stolen.

These are the issues that involve costly repairs or replacements and, in some cases, may make it difficult for you to host new guests for a while.

Even in these specific, very frustrating cases, always maintain calm and don’t take things personally — whatever happens, it’s just part of the business.

Understanding wear and tear

We’ve mentioned wear and tear early on in this blog, but what does that mean anyway?

Like in a regular home, some items in a vacation rental will naturally deteriorate over time, and a little faster than normal because they are used repeatedly by many guests.

When making a damage claim, hosts must consider the concept of ‘wear and tear,’ which relates to this sort of gradual damage. Examples of situations that fall under wear and tear include:

- Minor scuff marks on walls

- Aging furniture or appliances

- Residue from makeup left on hand towels or face washers

- Limescale buildup around the shower walls

- Tears in aging rugs or curtains

Let’s take a chair as an example. It might have surface scratches, color fading, and fabric wear caused by use over time. These issues are normal and expected, not the result of misuse or abuse.

It’s impossible to prevent wear and tear in a rental property. Still, regular maintenance and choosing high-quality, durable furniture and appliances help reduce the effects.

Through consistent maintenance and picking top-tier furniture and appliances, you can minimize the chances of guest damage and the need for expensive replacements. Pictured: the kitchen at Oceana in Treasure Island.

Take minor damages as ongoing expenses

Similar to hotels, hosts of short-term rentals in coastal Florida will often encounter minor damages to their properties.

As property managers in the St. Pete Beach region, we like to allocate a budget for addressing minor damages and general wear and tear — not more than a few dollars per night. That’s usually sufficient to protect hosts from unforeseen financial impacts.

An industry standard in our region is to set aside 5% of a host’s gross income for repair and maintenance expenses.

While it’s true that guests should be held responsible for any damage they cause, engaging in a battle for every claim can be exhausting and take all the joy away from hosting.

Resolving major damages

As with anything else in the world of vacation rentals, good and effective communication is also valuable when addressing damage claims.

If a guest books your beach rental through an OTA, it’s best to communicate with them through the platform’s official channels. That will keep a clear record of all message exchanges. Always maintain a polite tone, even if there’s a disagreement going on. It’s also useful to try to understand what happened and find out if guests are willing to cover the costs of the damage.

When you’re respectful and relatable, the results are usually better, and resolution is faster. But it doesn’t always work. When it doesn’t, you can hold their security deposit and launch the claim through the OTA platform.

Collecting supporting evidence

It doesn’t matter which platform you’re using; the more supporting evidence you provide, the higher your chances of getting your claim approved.

Here are some essentials to keep in mind:

1. Document the damages

Take pictures or videos of the damages right away to have proof. Close-up shots are very helpful, and as mentioned above, it’s a good idea to have “before and after” pictures.

You can ask your cleaning staff to take photos of your property while they’re working and send them to you before they leave.

2.Keep records of your conversations with guests

Chat with your guests using official channels and try to understand the situation first. If the situation calls for it, politely ask them to take responsibility for the damages and pay for the repairs.

3.Gather information about costs

Gather invoices, find links to replacement items showing prices, or get estimates from contractors. The OTAs will evaluate all these details when deciding if you qualify for reimbursement and how much you should receive.

It’s a good idea to ask your cleaning crew to eventually take photos of your property during their work. These photos can prove valuable in the event you have to file a claim with the OTA due to guest-inflicted damage.

Handling damage with direct bookings

Do you receive bookings directly from guests? In this case, it’s important to have a well-structured rental agreement to ensure damage protection.

Experienced St. Pete Beach property managers like us always collect government-issued identification from guests for that extra layer of security. With such precautions in place, you’ll be in a better position to protect your interests.

In some cases, however, you may need to seek legal advice from an attorney experienced in rental property issues, and that can be time-consuming and costly.

Other tips to minimize damage claims

Prevention is the best solution when it comes to damage protection. Here’s how you can do it:

- Set clear expectations for your guests. Tailor your rental to attract families to discourage parties, and emphasize this in your description. If you don’t allow pets, communicate this clearly in your description and rules.

- Avoid leaving valuable or irreplaceable items in the rental. Furnish your rental with high-quality items that are easy to replace.

- Communicate well with your guests. Establishing a good and warm relationship with guests helps them realize they’re staying in a privately owned rental, not a corporate hotel, and they are more likely to treat your home with care.

A guide to damage claims for St. Pete Beach vacation rentals

Owning a beach rental in the St. Pete Beach/Tampa Bay region at large is very rewarding, but it’s important to know that issues may arise.

As our partner’s stats show, damage claims are rare in this business, but when the need arises, being prepared and not getting too emotionally involved is the best way to deal with them.

Once the process is complete, you can turn your attention to what really matters in short-term rentals — providing a great experience for your guests and collecting the financial benefits.